valuable Support

As an experienced agent, I offer invaluable support throughout the home-buying process to ensure your success.

Expert Guidance

Expertise and insight throughout the complex real estate process, helping you make informed decisions every step of the way.

Local Market Knowledge

I have the tools and experience to serve as your local market guide, with information about trends, pricing, and availability to give you a competitive edge in finding the perfect home.

Negotiation Skills

You will have a fearless advocate who is armed with the data and negotiation strategies that can lead to winning offers and seamless resolutions.

Time-Saving Convenience

Offers, inspections, showings and more will be coordinated on your behalf, along with connections to necessary service providers like mortgage and title professionals.

Peace of Mind

Feel confident knowing that a professional is there to help you navigate any unexpected challenges or delays.

CHOOSING THE RIGHT PARTNER

When you choose me to represent you, you'll have an experienced advocate by your side every step of the way, giving you the insights and information you need to make confident decisions.

-

Help you establish your budget and connect you with a reputable lender to get pre-approved for a mortgage.

-

Discuss your needs and goals, and plan your property search criteria

-

Agree upon the parameters of our working relationship

-

Coordinate showings for properties that meet your needs and explain/negotiate features

-

Keep you informed of new properties that come on the market that would interest you.

-

Help you understand the market data for any properties of interest.

-

Work with you to find the right home.

-

Assist in determining your offer, including developing a multiple-offer strategy.

-

Review and discuss details of the seller's disclosure.

-

Apply my expertise in negotiating the offer and contract terms in your best interest.

-

Facilitate the home inspection and resolution process.

-

Offer information on reliable contractors and service providers.

-

Address any issues regarding appraisal, survey, title, contingencies, etc.

-

Prepare you for closing and the associated costs.

-

Provide clear and constant communication to keep you updated on the progress of your transaction.

The Power of Partnership

Guaranteed Rate Affinity is our preferred mortgage lender because they provide the best mortgage experience possible, featuring incredibly low rates, fantastic customer service and a fast, simple process. Connect with my preferred mortgage lender below to experience the Guaranteed Rate Affinity difference for yourself.

THE POWER OF PRE-APPROVAL

An important first step in any home search is finding out exactly how much home you can afford and securing the necessary financing. While you can get a rough estimate through pre-qualification, taking the extra step to obtain pre-approval will give you some added advantages. Pre-approval helps you:

-

Help you establish your budget and connect you with a reputable lender to get pre-approved for a mortgage.

-

Discuss your needs and goals, and plan your property search criteria

-

Agree upon the parameters of our working relationship

When you find a home you love and are ready to make an offer, your mortgage pre-approval lets the seller know that you're serious and fully prepared to buy their home, putting you in a stronger position than other potential buyers.

Some of the documents your lender will request to get the pre-approval process started:

-

Income

Current pay stubs, usually for the last two months.

-

W-2s or 1099s, usually for the last two years.

-

Tax Returns, usually for the last two years

-

Assets

Bank statements

-

Investment/brokerage firm statements

-

Net worth of businesses owned (if applicable)

-

Work with you to find the right home.

-

Debts (if applicable)

Credit card statements

-

Loan statements

-

Alimony/child support payments

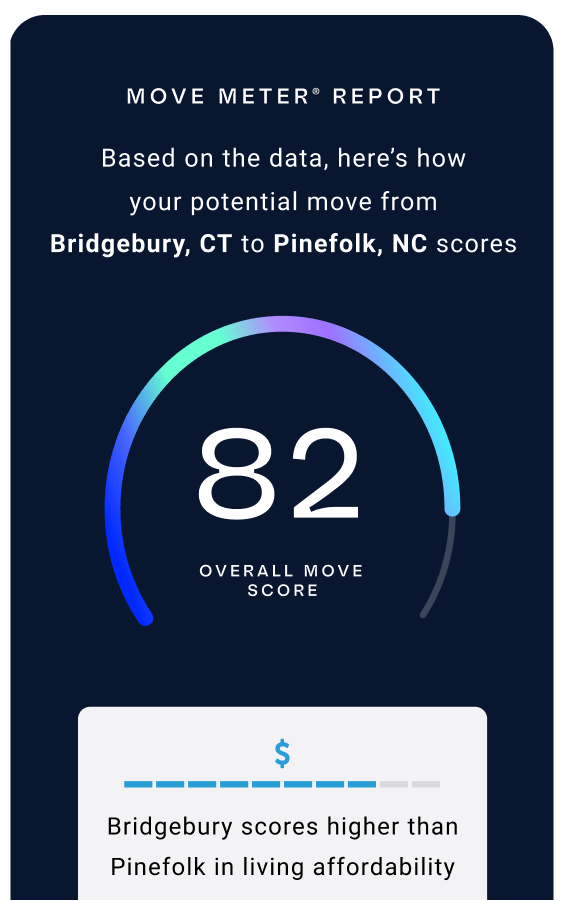

The Move Meter® lets you compare locations based on living affordability, average home prices and other important factors.